China Bedding Development And Trend In 2023

China’s bedding industry development status and trends in 2020, the rapid increase in the proportion of online channels

Bedding Development Overview

Bedding, is an important part of the home textile industry, as it is an item placed on the bed for use during sleep. There are many different types of products, which can be divided into four main categories: covers, pillows, bedding and suites.

Analysis Of Bedding Development In China

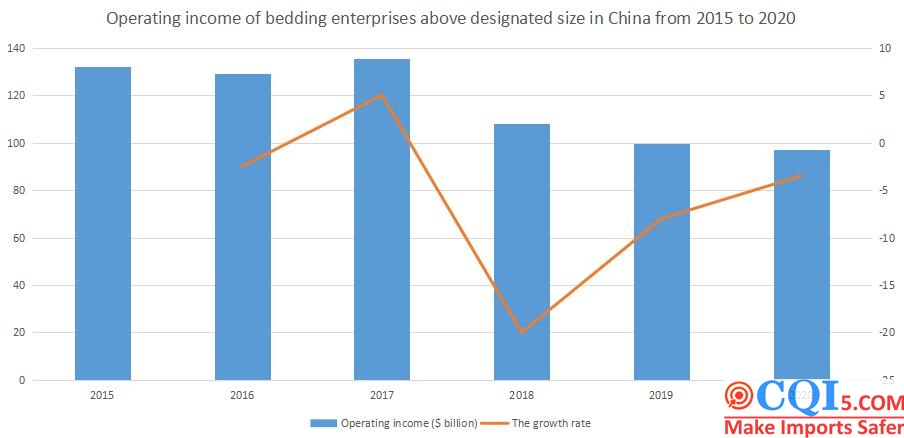

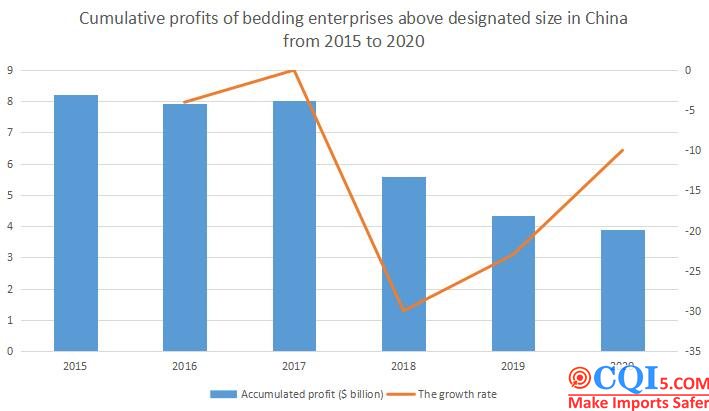

China’s bedding industry has been in the doldrums since 2017 due to the slowdown in demand. 2020 saw a decline in revenue and total profit, compounded by the epidemic. 2020 saw revenue of US$9.7 billion from enterprises above the scale of China’s bedding industry, down US$248 million or 2.5% from the previous year; total profit from enterprises above the scale was US$389 million, down 10.1% from the previous year. A year-on-year decline of 10.1%.

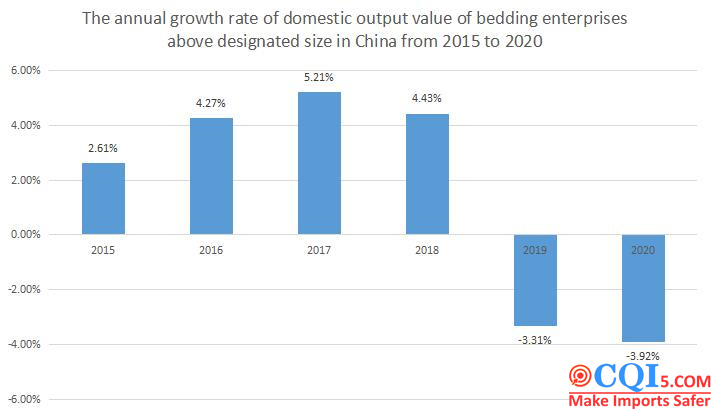

In 2019, the domestic sales output value was US$6.79 billion, down 3.31% year-on-year, the first negative growth in nearly six years; in 2020, the domestic sales output value remained in negative growth, with the domestic sales output value of all 973 bedding enterprises above the size of China at US$6.524 billion, down 3.92% year-on-year.

Competition Pattern Of Bedding Development

There are a total of 973 enterprises above the scale in China’s bedding industry, of which the front-end brands are excellent self-branded bedding manufacturers such as Luolai, Fu Anna, Shuixing Home Textiles and Mengjie, while the third echelon are tens of thousands of small and medium-sized bedding manufacturers.

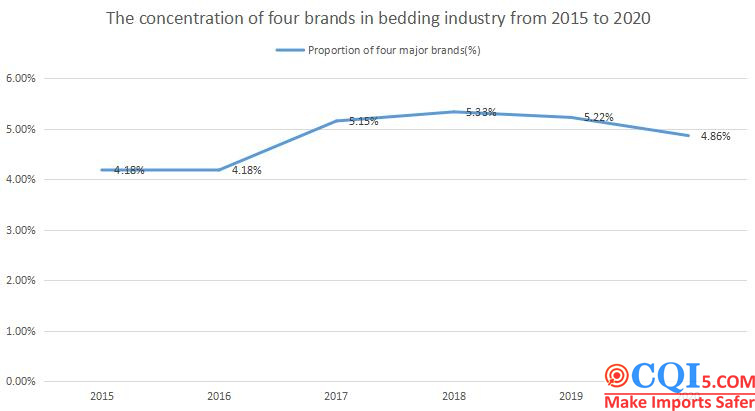

The market share of the main bedding brands, i.e. Luolai Life, Shuixing Home Textiles, Fu Anna and Mengjie, has remained at around 5% in recent years, with an increase of 0.68% compared to the overall industry concentration in 2015, rising from 4.18% to 4.86%.

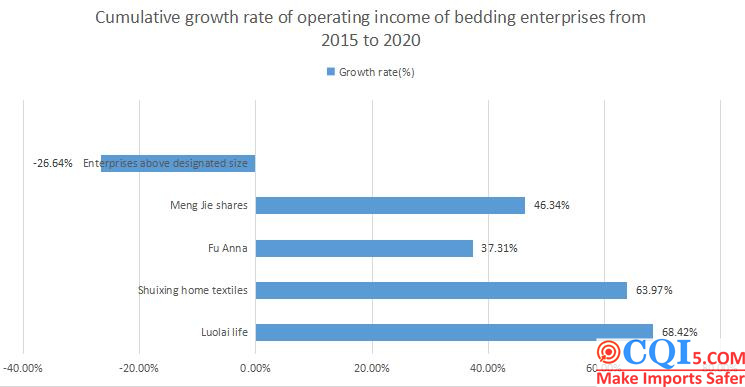

From 2015-2020, the main operating income of bedding companies above the scale in China fell from US$13.226 billion to US$9.7 billion, a decline of 26.64%. At the same time, Luolai Life, Shuixing Home Textiles, Fu Anna and Mengjie achieved operating revenue growth ranging from 30%-70% respectively during the six-year period, significantly outperforming the industry as a whole.

Future Development Trend Of China’s Bedding Development

1, online channels accounted for a rapid increase

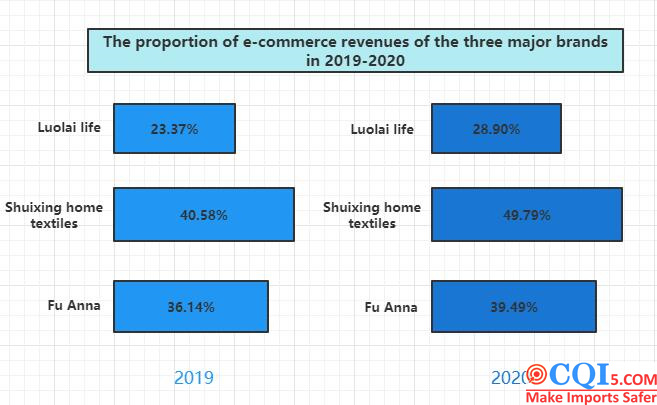

In recent years, the rapid expansion of online channels in the home textile industry has become one of the important sources of power for the steady growth of the industry scale, from the performance of the specific brand end of the front-end home textile brands: Luolai Life achieved an increase in the share of e-commerce business from 23.37% to 28.90% in 2019-2020 through the expansion of new social e-commerce and the construction of WeChat mini-programs; Shuixing Home Textiles developed its e-commerce business earlier and the share of e-commerce business accounted for 40.58% in 2019 to 49.79% in 2020, accounting for nearly half of the total; Fu Anna’s sales revenue from e-commerce channels reached 39.49% in 2020, with net profit margin rising to 16.53%.

Transformation And Upgrading Of Bedding Development In China

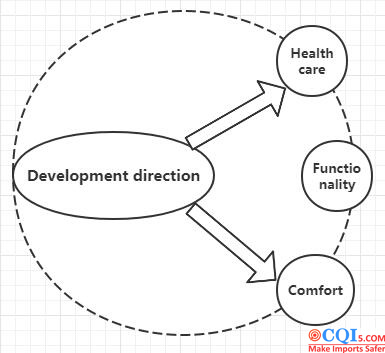

As a necessity, the quality, features and functionality of bedding are its greatest competitive advantage. In the future, with the upgrading of consumption, consumers will pay more and more attention to the functionality of products, and the unique high-tech content and high added value of functional bedding will become a new driving force for the development of China’s bedding industry.

CQI5 is committed to providing importers worldwide with product quality inspection services that far exceed those of our peers. If you are planning to import or have imported from China or Southeast Asian countries, please contact us cs’@’cqipro.com to learn more about how we can make your imports safer.

Disclaimer:

CQI5 article information from the Internet and contributions, the copyright of which belongs to the original author, and only represents the views of the original author. This website is only responsible for sorting out, typesetting and editing the articles, reproduced for the purpose of spreading more information, does not imply that it endorses its views or proves the truthfulness, completeness and accuracy of its content, and therefore does not assume any legal responsibility.

The information contained in this article is for reference only and is not intended as direct advice for decision-making.

If we inadvertently violate your copyright, please inform us, after verification, we will immediately correct or delete the content according to the requirements of the copyright holder, thank you! Contact, email: copyright@cqipro.com

This website has the final right to interpret this statement.

Welcome to reprint, please be sure to keep information complete.