A Complete Supply Chain, Improving The Efficiency Of All Parties

Not “fancy”, but only $8!

CQI had no idea that the soft, smooth, pink silicone facial cleanser would be so roughly produced. In the huge silicone manufacturing plant in southern China, which used to make adult products for big foreign brands, the hot, clear gel tilting down, and two tall, cylindrical mechanical arms churning the silicone – the dull roar of machinery in ears, the army green machine was many years old. The casing is a little mottled, a little white dust is scattered around the machine, and there are piles of material in the workshop.

A Complete Supply Chain To Reduce Seller Costs

When you saw the workers manually placing the dough-like silicone on the press, you would feel “not very high class.” But the opportunity to make at least tens of millions of dollars a year is here in this not-so-high-class Chinese factory.

A facial cleanser like this costs at least $260 on Amazon, and CQI consulted a friend in Shenzhen who works in small appliances: “Can you take it apart and help me see how much it’s worth?” The next day, my friend called and told me it was only worth US$8!

In this huge price difference, there is clearly an opportunity. By chance, CQI met a Hong Kong resident who had a side business making beauty devices. She found a factory in the Pearl River Delta to label her products and sold them to offline shops in Hong Kong, where they could reach over US$300 a unit. With this not-too-expensive model of manufacturing in the Pearl River Delta and selling in Hong Kong, she makes US$3-4 million a year.

CQI has taken stock of the new consumer brands that have emerged in China in recent years, and we find that too many of them are from the Pearl River Delta: Perfect Diary, colorkey and Shein have their home base in Guangzhou, NARWAL has its factory in Dongguan, and Little Bear Electrical is in Shunde ……

Why do so many successful new consumer brands come from southern China? To a large extent, this has to do with the proximity to a complete supply chain and having the advantage of low prices. Perfect Diary is half the price of L’Oreal, and electric toothbrushes that sell for thousands of dollars may cost as little as $26 when they leave the PRD factory.

When discussing how to win in the new consumer branding boom, a growing number of practitioners feel that the key to winning is a “complete supply chain“. But the secret of the supply chain is not just “low price”.

What is the key to winning the “complete supply chain”?

A Complete Supply Chain To Improve Production Efficiency

Thirty years of craftsmanship and business

One of CQI’s acquaintances, Jack, a owner of leather goods , told us the story of how he made his fortune.

When Jack was working as a laid-back designer and running a leather goods shop in Hangzhou, he often received the wrong leathers sent to him, but he tended to make minor alterations and repairs and just used them. It wasn’t until the 2016 season that he decided to do a proper business. He had four new models in a row and had published photos of them early on. But before work started, Jack got the goods and the texture of the leather was not right. A week later they received the goods again and the colour was wrong again. By the time their leathers arrived, the season was over. “The next day I thought, it’s not right to keep doing this.” Jack recalled to us.

Anyone in the leather goods business knows that Sanyuanli in Guangzhou can’t be avoided. This 400,000 square metre area is home to 30 large, medium and small leather goods markets. 65% of China’s leather goods come from Guangdong, and the Sanyuanli leather goods shopping district accounts for a large part of Guangdong’s exports and total export value. Until 2021, to source the cowhide needed for high-end bags, one still has to go to Sanyuanli stall by stall to get the goods. This is the world’s largest leather sourcing centre, with thousands of shops crammed in from 1 to 6 floors, where buyers can find crocodile skin, lizard skin and pearl fish skin.

In 2017, Jack decided to move his family to Guangzhou, China. The new company landed in the Baiyun District of Guangzhou, where there is a concentration of suppliers who manufacture middle and high-end luggage. One of the foundry factories is located in Baiyun District Industrial Park, 3 km from the company. The roadside of this seemingly unplanned factory is full of small rectangular advertisements or crooked handwriting: “factory for rent”, “forklift for rent”.

But the craftsmanship of the experienced workers here are really surprising. So soon the first sample came out, Jack took this full and rounded bag in his hand, his heart could not help but exclaim: “really great!” He also set a processing fee of $19 a piece, “there is still money to be made anyway,” he thought. At that time, the processing fee for an ordinary e-commerce brand bag was only about $15.

The workers of this factory are generally older, wearing loose T-shirts, shorts and slippers. Their movements were unhurried, and this factory of about 200 people produced only a few hundred a day. But on the eve of 2020, the night of the Chinese shopping spree, they sold 23,000 bags – but they had only stocked over 10,000, leaving a shortfall of 8,000!

Everyone poured out, went to the stall with several times the high price to collect leather, sat in the factory and the boss said: can not rest, have to catch up with our goods! Relying on this group of skilled workers alternating black and white shifts without rest, within a week, they actually made 8,000 bags. “This is the most mythical inside the (design brand) industry, no one has done it before.” Jack told us.

In the highly professional Pearl River Delta, a sufficiently mature and complete industry chain has become a safety net for the young brand.

5 hours around the “world factory”: from Shenzhen Dongguan, to Foshan Zhongshan

First we went to Longhua Industrial Zone, the most concentrated factory in Shenzhen, China. Here is the iPhone manufacturing plant Foxconn Guanlan factory, this one area last year, “the annual main business income of more than 20 million yuan enterprises,” the industrial output value is 516.8 billion.

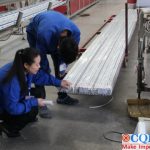

In the intelligent factory, we can see the scene of a typical electronic product assembly line: cold white light, stamping machine every 3 seconds to issue a “snort” dull sound, which will be mixed with the “drip” sound of some other machines, breathing can smell the fishy smell of metal friction.

From Guangzhou to the south, it entered the affluent Shunde District of Foshan City. In 2020, Shunde’s GDP was 366.76 billion yuan, almost as much as the GDP of China’s entire Ningxia province. But we don’t see too many signs of luxury. It’s hard to even find shelter under the blazing 35-degree Celsius sun – vegetation is the most superfluous decoration for an industrial city.

Shunde is a city that belongs to the manufacturing industry. It accounts for 40% of the output value of small home appliances in China, and there are nearly 3,000 home appliance and supporting enterprises, including the Midea , which has a market value of nearly 500 billion yuan. With the Midea’s factory as the core, radiation out of many factories doing small appliances. The aforementioned beauty device to use dozens of parts, silicone, motors, gaskets …… can basically be found in Shunde.

Drive south for another hour, is the industry rich to the crowded city of Zhongshan. According to the data, Zhongshan has 800 industrial parks planned, more than a city in Hefei, China. There are 17,000 beauty-related companies, large and small, in Zhongshan, including DARLIE toothpaste, which has a 17 percent market share, and Mentholatum which has an output value of more than $2 billion.

Nearly every city here has its own name, often with the prefix “world. Zhongshan City is the “light capital of the world”, last year only LED lights exported 390 million U.S. dollars; Zhanjiang City to produce 65 million rice cookers each year, accounting for more than 60% of the world’s total production; and more than half of China’s hardware knife and scissors factories are in Yangjiang City.

From Shenzhen, to Dongguan, Guangzhou, Foshan Shunde, Zhongshan, as long as the drive 5 hours, you can go around the “world factory” a circle.

Times have changed: from foreign trade orders to online shopping.

Many factory owners are worried: why before the product is quite easy to do, now it is not easy to do? So now how to do well? This is both the change in user demand, but also and the international market environment changes.

For manufacturing companies, the conventional practice is to take orders. And now, those who can survive must look toward the Internet. The metamorphosis is not pleasant for the owners to talk about. Many factories have had to pull up the “anchor” that has given them peace of mind for the past 10 or 20 years and move into the unknown. But these factories can no longer escape the reality that in today’s turbulent world trade environment, relying purely on overseas orders is no longer a safe option.

In the case of OEM/ODM for personal care appliances, for example, the top 10 companies accounted for only about 17.5% of the market. The third ranking, however, it accounts for about 1.3% of the total market. They have been in a price war of mutual exclusion for a long time, and even the big factories can’t rest on their laurels. Proactive change and cooperation with promising new brands may be a good way out.

For more than 30 years, these factory owners have been navigating a world of change and ups and downs. Only this time, whether it’s the pace of production lines or the speed of product iteration, they need to catch up a lot faster. A personal care ODM owner who has worked with many Japanese customers told CQI that it usually takes a year for Japanese customers to plan to finalize their products, and they can go seven or eight years without changing their appearance or adding features. Now he is in contact with new consumer brand customers who are developing and mass producing a new product from scratch in as little as six months.

Just because these factory owners are starting to sweep away the slow, conservative vibe doesn’t mean they’re becoming adventurous. For them, the essence of taking orders, making orders, and delivering has remained unchanged for decades. However, the direction of the tide is definite, the gold seekers from the south are continuing to arrive, and things will not go back to square one.