How Importers Respond To Fluctuations In Container Freight Rates

“The Black Friday and Christmas shopping seasons are just around the corner, but what about the US importers who are still short of stock?

Ample food and clothing by working with our own hands. For nearly a month and a half, “ TY”, the maker of Beanie Babies, the doll toy that has been popular in North America for years, has accumulated more than 150 charter flights between China and the US to bring the plush toys to the US, successfully bypassing the century-long congestion at US ports.

The planes, which took off from Shenzhen, Guangzhou and Shanghai in China with a variety of beanie baby dolls, flew 6,000 miles to arrive at Chicago’s O’Hare International Airport on time, at a cost of between $1.5 million and $2 million per flight, according to Ty.

This is not an extreme example: Ty is not the only company choosing to airlift important holiday products to avoid shipping woes in the run-up to the holidays.

We found that manufacturers of footwear and apparel brands such as Nike, Levi Strauss & Co., Lululemon, Ralph Lauren, Under Armour, Adidas and others, have reported using more expensive air freight to bypass congested ports or to replenish inventory.

“Nothing is impossible .” A freight forwarder friend point out the current situation is: “If you need it, there is nothing you want to ship that we can’t do. For example, for some much-needed special commodities, sea, land and air ‘up and down’, all modes of transport are now being used, but this look does not meet some of the needs in the market.”

The manufacturer came to China to pick up the goods themselves.

Upon arrival in Chicago, the Beanie Babies are delivered to TY’s warehouse in Bolingbrook, Illinois, and then distributed to retailers across the country.

With this strategy in place, TY has managed to bring back millions of Beanie Babies in a month and a half, shortening the time it takes for goods to reach the shelves. The company said in a news release that it would not raise prices and would remain at $5 to $10 for this plush toy.

For his part, TY CEO Warner said in a recent release, “The widely reported global supply chain issues have cast a shadow over the upcoming Christmas season, and there has been so much doom and gloom. But I want to tell our customers that despite what they may have read or heard, Christmas has not been cancelled.”

As mentioned earlier, TY is not the only company to have resorted to using air freight as a solution to its logistical woes. Under Armour, for example, has used a lot of air freight this year.

“We’re not jumpy about it, but it’s something we’re all challenged with.” Under Armour’s chief financial officer said.

Container Freight Soars

While air freight has always been more expensive than sea freight, supply chain bottlenecks are pushing up the cost of sea freight and closing the gap: before the outbreak, air freight was more than 12 times more expensive than sea freight; but as of September this year, it was only three times more expensive. However, being able to pick up goods in China also requires that the company itself has a warehouse in the US or can find one to store them.

The chief executive of Kids2, a toy manufacturer with several brands including Baby Einstein, said there has been an increase in demand from retailers wanting to pick up goods directly from its Chinese factories. A total of 10 major retailers have now come to him asking to do so. He also helped partners find much-needed products, even computer chips. The CEO said:”retailers come to big companies like us to help them with some of their supply chain challenges. We had a retailer come to us and say we could work together and increase demand by 30 per cent. Things like this have come up four or five times.”

Sea Container Freight Rates Down, But No Qualitative Change In Congestion

The CEO of bicycle business Lectric eBikes said that the delay process could now take weeks rather than days if using the port in Los Angeles. For example, at the height of delays in February and March, it took him five to six weeks to find his shipment from the moment the inventory arrived at the port.

“The third party logistics distribution centre in Los Angeles is no longer available. They don’t have enough capacity to solve the problem.” When things started to get crowded at the Port of Los Angeles this year, he said, he abandoned the Port of Los Angeles’ handling system and built his own warehouse in Phoenix. Since August, the business has been turned into a company with an inventory.

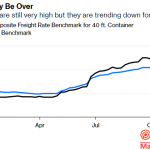

This was a very wise move. Since August, prices on the US-West sea route have risen even more dramatically. The supply headwinds “will undoubtedly make this an unusual year for holiday shopping”. Although inflation and shortages of goods exist, this has not dampened the holiday shopping enthusiasm of U.S. consumers in any way. Good spending fundamentals for US consumers and the need to make up for last year’s social distance have made this the strongest holiday season since 1999; at the same time, container shortages and backlogs have caused freight rates from China to the US West Coast to soar 339% year-on-year, that means an average of over $17,000 FEU (40 foot standard container) per container.

The good news so far is that trans-Pacific container shipping costs fell by almost a quarter last week compared to the peak of the year, marking the biggest one-week drop in two years. As of 21 November, the Global Container Freight Index shows that freight rates for 40ft TEUs from China to the US West Coast are currently at US$16,124 per FEU.

The fall in shipping rates indicates that demand may be starting to slow down. Global supply chain disruptions are set to peak this quarter (fourth quarter of this year) and the supply chain disruption problem is now easing, with global freight rates falling over the month. Perhaps by the second half of 2022, supply chain disruptions should largely abate, but the risk remains.

However, while there are now signs of slowing demand, there has been no qualitative change in congestion at the gateway ports for US imports – the ports of Los Angeles and Long Beach in California. There are currently 159 vessels waiting outside the two ports, 101 of which are container ships.

The aforementioned freight forwarder friends said that in the fourth quarter of 2020, and so far in the first quarter of 2021, all sorts of unexpected situations have arisen and “we are under very great pressure to complete the logistics transport with the transshipment.” They analyse that in terms of shipping, people feel that by the end of 2022 it will be more or less normal. If we look at the Chinese market, after the Chinese New Year next year, the practitioners will be under a little less pressure.

Disclaimer:

CQI5 article information from the Internet and contributions, the copyright of which belongs to the original author, and only represents the views of the original author. This website is only responsible for sorting out, typesetting and editing the articles, reproduced for the purpose of spreading more information, does not imply that it endorses its views or proves the truthfulness, completeness and accuracy of its content, and therefore does not assume any legal responsibility.

The information contained in this article is for reference only and is not intended as direct advice for decision-making.

If we inadvertently violate your copyright, please inform us, after verification, we will immediately correct or delete the content according to the requirements of the copyright holder, thank you! Contact, email: copyright@cqipro.com

This website has the final right to interpret this statement.

Welcome to reprint, Please be sure to keep information complete.