Analysis Of The Situation Of China Garment Exports In 2020

As a traditional pillar industry of China’s national economy, the apparel industry has an important position in the macro industrial layout of China. According to the National Bureau of Statistics, in 2019, enterprises above the scale of China’s apparel industry achieved a cumulative operating income of RMB 1,601.033 billion, accounting for 1.51% of the RMB 105.78 trillion operating income achieved by industrial enterprises above the scale of the country in that year.

Analysis the China garment export status and industry chain in 2020

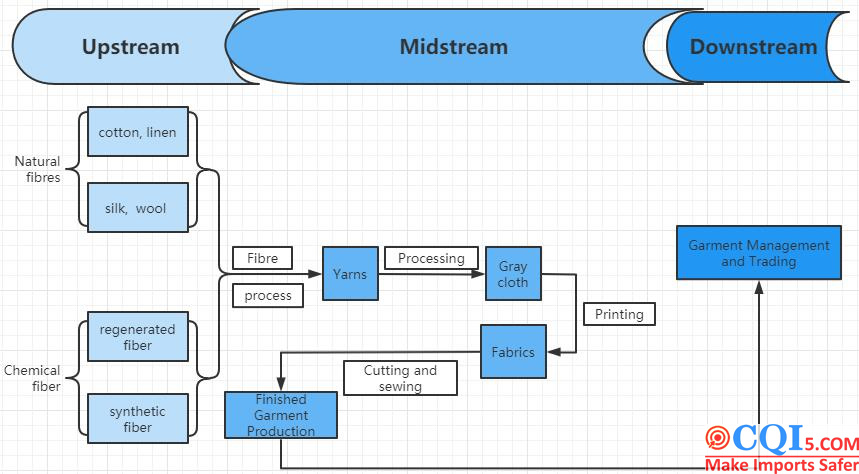

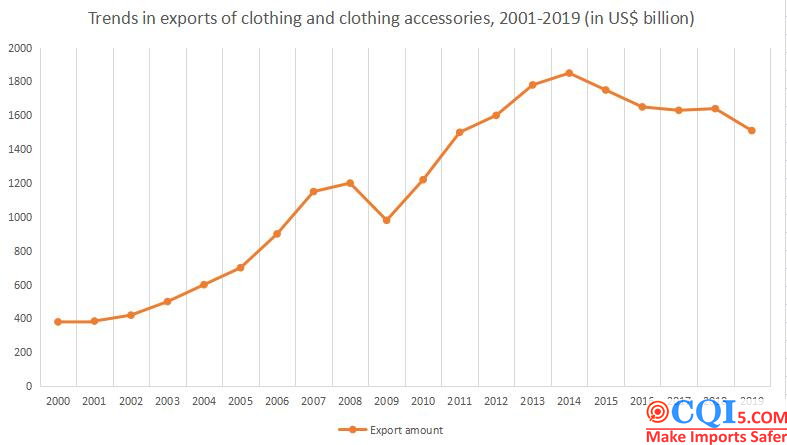

From the viewpoint of the garment industry chain: the various links in the industry chain mainly include raw material supply, spinning, weaving, printing and dyeing, finishing, garment production, brand garment management, etc. Since China’s accession to the WTO, the export environment has become increasingly relaxed. The favourable trade environment has prompted domestic garment manufacturers to rapidly increase production to cope with the increasing overseas export orders. Since 2001, China’s garment export trade has quadrupled, thus enabling the Chinese textile and garment industry to increase its market share in international trade significantly, and the textile and garment industry chain has become increasingly complete in meeting the large number of international market demands, with the competitiveness of each link in the industry chain having improved considerably.

Distribution Of Raw Materials In The China Garment Exports Industry

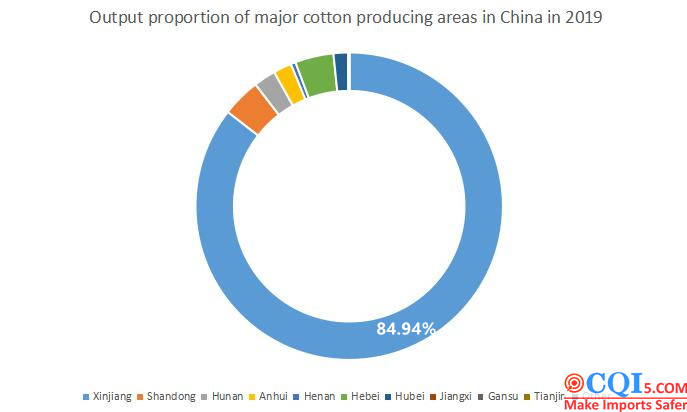

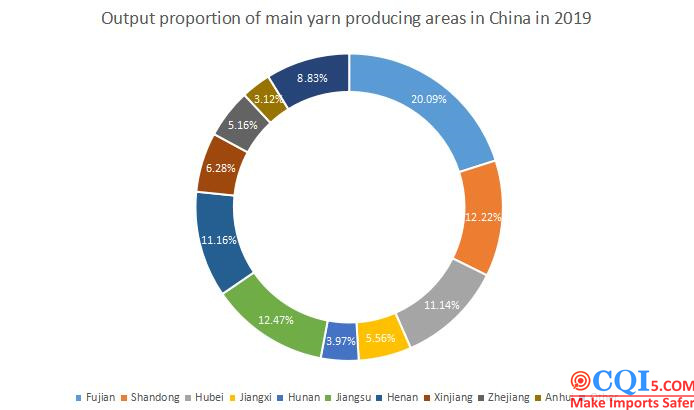

In recent years, the apparel industry in China has developed very rapidly. An important factor in the rapid development of the apparel industry is that China has abundant sources of raw material supply. Raw materials for clothing, mainly cotton, linen, wool and silk, are characterised by large supply volumes and regional concentration. Henan and Shandong provinces in the middle and lower reaches of the Yellow River, as well as Hubei, Jiangsu, Anhui and Jiangxi provinces in the middle and lower reaches of the Yangtze River, are important raw material supply areas for the garment industry. According to the National Bureau of Statistics, yarn production in the five provinces of Fujian, Jiangsu, Shandong, Henan and Hubei reached 67.08% of the country’s total output in 2019, while Xinjiang is the main cotton-producing region in China, accounting for more than 80% of the country’s total cotton production in 2019.

At present, China’s textile and garment processing raw materials supply area is relatively concentrated, coupled with the advantage of demographic dividend, perfect transportation facilities contributed to the rapid development of China’s garment industry in the past decade in the environment of strong external demand growth, and the formation of China’s coastal areas mainly covering raw material procurement, processing production, export trade integrated industrial clusters.

Analysis of the current situation of China’s garment industry exports

Since China’s accession to the WTO, textiles and garments have become one of the most important components of China’s foreign exports. With the gradual abolition of the industry’s export quota system over the past decade or so, China’s garment textile and apparel exports have enjoyed a more relaxed external environment. This favourable external environment has provided the most basic conditions for the international development of China’s garment industry. On this basis, the international competitiveness of Chinese textiles and garments has been further enhanced by China’s advantages in labour costs and raw material supply. Since China’s accession to the WTO in 2001, the value of China’s global exports of textile and apparel products has increased more than fourfold, and China has now become the world’s largest producer and exporter of apparel.

According to customs data: China’s cumulative exports of textiles and garments in 2019 amounted to US$271.836 billion, down 1.89% year-on-year, of which the cumulative exports of textiles amounted to US$120.269 billion, up 0.91% year-on-year, and the cumulative exports of garments amounted to US$151.36 billion, down 4.00% year-on-year. Europe, the United States and Japan are the main textile and apparel exporting countries and regions of China.

In terms of the structure of export commodities, the cumulative amount of garment exports in 2019 was US$151.367 billion, of which US$60.600 billion was exported in knitted garments, down 3.37% year-on-year, and US$64.047 billion in woven garments, down 6.69% year-on-year.

Disclaimer:

CQI5 article information from the Internet and contributions, the copyright of which belongs to the original author, and only represents the views of the original author. This website is only responsible for sorting out, typesetting and editing the articles, reproduced for the purpose of spreading more information, does not imply that it endorses its views or proves the truthfulness, completeness and accuracy of its content, and therefore does not assume any legal responsibility.

The information contained in this article is for reference only and is not intended as direct advice for decision-making.

If we inadvertently violate your copyright, please inform us, after verification, we will immediately correct or delete the content according to the requirements of the copyright holder, thank you! Contact, email: copyright@cqipro.com

This website has the final right to interpret this statement.

Welcome to reprint, please be sure to keep information complete.